The Amount Earned From an Expenditure Best Describes

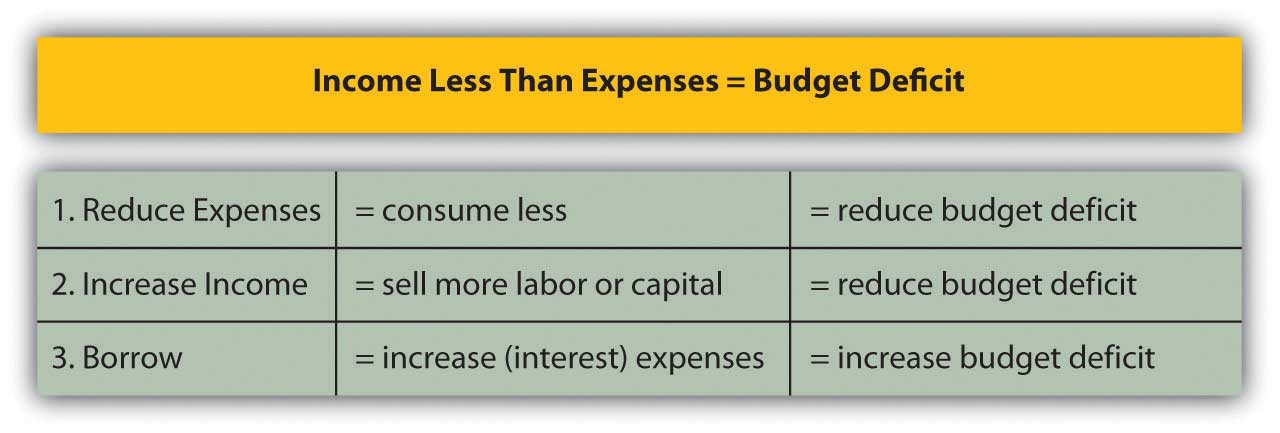

The amount earned from an expenditure best describes. A has a less complicated effect on GDP than does a tax cut of a fixed amount.

The change in retained earnings equals net income less dividends.

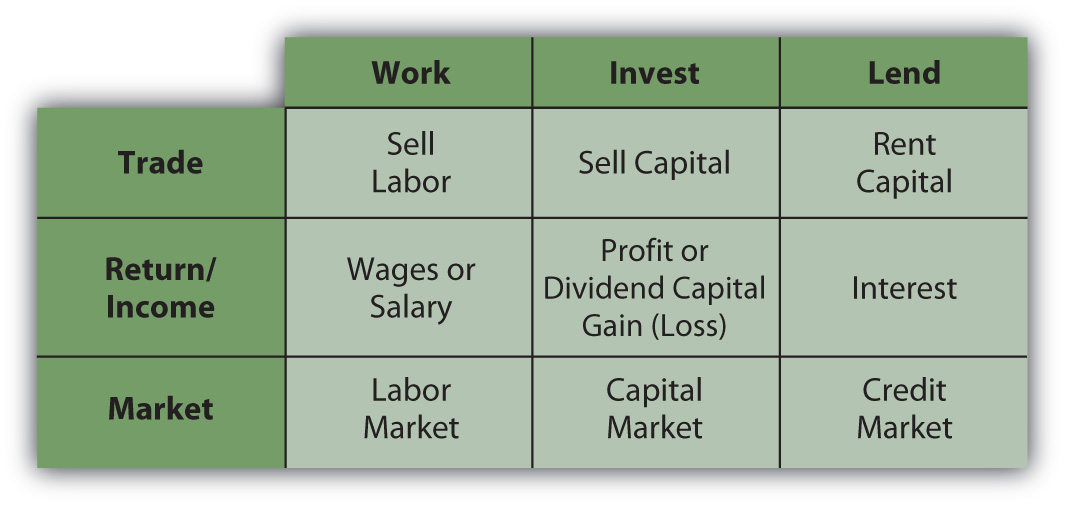

. National income adds up all of the wages rents interest and profits and losses earned from our resources. For example the same 10 million piece of equipment with a 5-year life has a depreciation. Net future value D.

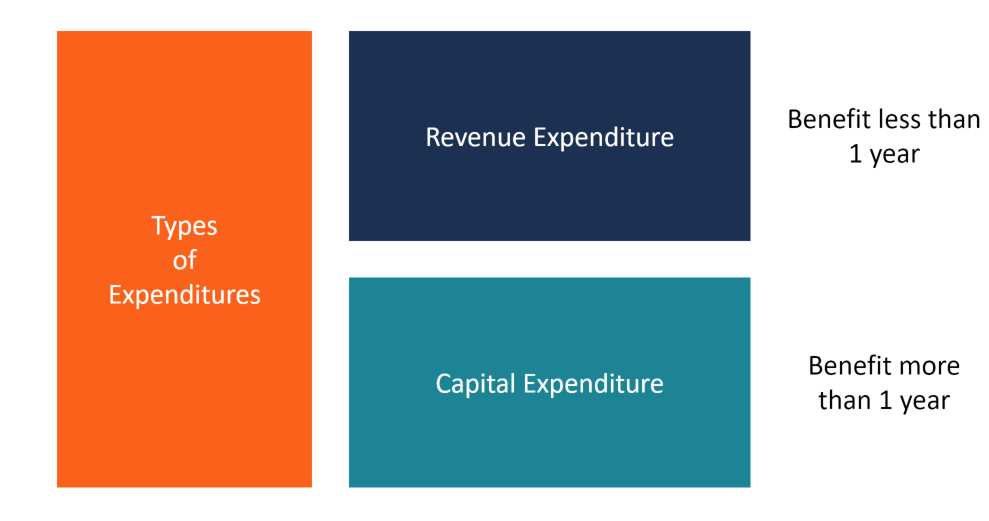

Conversely the income approach starts with the income earned from the production of goods. This would be classified as a 10 million capital expenditure. National Income Wages Rents Interest Profits and Losses.

Earned income is income derived from active participation in a trade or business including wages salary tips commissions and bonuses. Match the given statement to the program that best describes the. Long - term debt principal retirement.

The following eight statements involve the redistribution of income expenditure programs. Expenditures in the United States Amount of Expenditure billions of Expenditure. GDP C I G NX.

Fair value of an asset is the price that would be received to sell an. View ACCT310 Unit 4 - Operating and Capital Expendituresdocx from ACCT 310 at American InterContinental University. Unit 4 Operating and Capital Expenditures Which of the following.

Which statement is true about current value. Activity 6 Multiple Choice Estimated time required 5 minutes 1. The amount earned from an expenditure best describes.

Vertical integration Zara makes 40 percent of its own fabric and purchases most of its dyes from its own subsidiary. The formula for the calculation of the Gross Domestic Product GDP of the country using the expenditure approach is as follows. This is the opposite of unearned.

Published by firms that tell others programs. Salaries and wages. The amount of interest or claim that the owners have in the business Od.

However the income earned from the petting zoos is kept. Interestingly the tax multiplier is always smaller than the expenditure multiplier by. Resources of the company equal creditors and owners.

Return on investment E. Salary is the term generally used to refer to the annual amount of wages. Equality of revenue and expense transactions over time.

The amount earned from an expenditure best describes. Expenditures in a governmental expendable fund would not potentially include. With this relationship in mind consider the.

A number of times suffered. Expenditure is incurred once in a period. Benefits are automatically calculated and included by Payroll.

Expenditure is usually the long-term costs of the organization. The expenditure approach begins with the money spent on goods and services. The table below shows hypothetical values of the expenditure components for the United States in 2016.

For example if the marginal propensity to consume out of the marginal amount of income earned is 09 then the marginal propensity to save is 01. C will not affect disposable income. Expense This is the amount that is recorded as an offset to revenues or income on a companys income statement.

An expense incurs multiple times. B has a larger multiplier effect the smaller the tax rate. The aggregate expenditure determines the total amount that firms and households plan to spend on goods and services at each level of income.

Hamsterville also has a thriving tourism industry in which cruise ship passengers visit and pay admission to hamster petting zoos. The tax multiplier tells us the final increase in real GDP that will occur as the result of a change in taxes. Up to 256 cash back National income is the total amount earned by the citizens of a country while gross domestic product is the total value of goods and services.

Over the first four rounds of aggregate expenditures the impact of the original increase in government spending of 100 creates a rise in aggregate expenditures of 100 90 81. D will not affect.

What Is An Expenditure Overview Guide And Examples

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Income Statement Definition Uses Examples

Cost Control Templates 5 Free Printable Docs Xlsx Pdf Cost Control Small Business Finance Financial Management

Comments

Post a Comment